Hey there, money maestro! Ready to turn your finances into a breeze? Well, grab your wand—aka the 50/30/20 rule—and let's make managing money as easy as saying hello!

Imagine a life where money worries take a vacation, and you can spend without the stress. That's the dream, right? Managing money wisely is your ticket to that dreamy, stress-free zone!

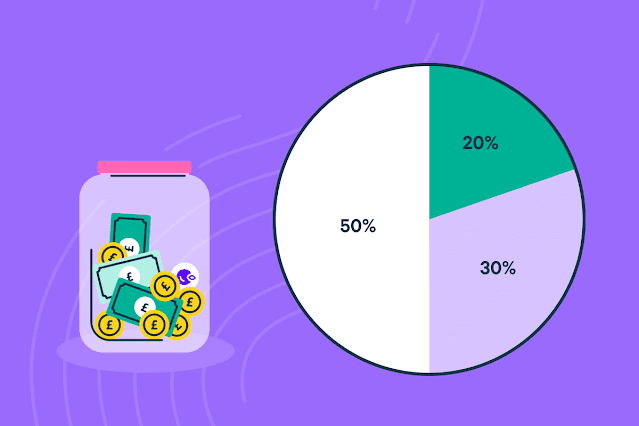

Meet the 50/30/20 rule—a super-friendly guide to divvying up your cash without making your brain do gymnastics. No fancy lingo, just easy-peasy money wisdom!

Your Money Breakdown:

- 50% for Needs: Half your money goes to must-haves like rent, groceries, and keeping the lights on. Boring stuff, but super important!

- 30% for Wants: The fun zone! Thirty percent is your ticket to dine out, enjoy movies, and all the cool stuff that makes life awesome!

- 20% for Savings and Debt Repayment: The secret sauce! Twenty percent is like your superhero cape—it saves for emergencies, plans for the future, and crushes debt. Boom!

What's cool about the 50/30/20 rule? It's as simple as saying 'abracadabra'! No math headaches—just a clear guide to make your money dance to your tune. Ready to dive in? Let's go!

1. Needs - 50% of Your Budget

Alright, let's dive deeper into the world of Needs—these are the essentials that take up a solid 50% of your budget. It's like giving your money a to-do list, and these tasks are the VIPs:

1.1. Understanding "Needs":

Needs are the non-negotiables, the things that keep your life running smoothly. They're like the superhero cape for your budget, ensuring you have a comfortable and secure life. Let's meet these VIPs:

1.2. Examples of Needs:

- Rent: Your cozy space to call home. We've already shared savvy tips on how to save money on rent in New York City and San Francisco.

- Utilities: Keeping the lights on and water running.

- Groceries: Fuel for your body and soul. Remember, we've got strategies on how to save money on groceries, even in pricey places like NYC.

- Healthcare: Taking care of yourself and your loved ones.

1.3. Why Prioritize These Necessities?

Think of Needs as the foundation of your financial house. Imagine trying to build a sturdy house without a strong base—it wouldn't work well. By covering your Needs first, you create stability and peace of mind. It's about ensuring that your superhero money is working for you in the most important areas of your life.

So, let's make sure your money superhero is an expert at taking care of these VIP tasks, making your financial foundation rock-solid!

2. Wants - 30% of Your Budget

Alright, let's dive into the exciting world of Wants—these are the goodies that make life colorful, taking up a delightful 30% of your budget. It's like giving your money a VIP pass to the fun zone:

2.1. Understanding "Wants":

Wants are the extras, the special treats in your financial menu. These are non-essential delights that bring joy and flavor to your life. It's not just about surviving; it's about thriving and enjoying the journey.

2.2. Examples of Wants:

- Entertainment: From movie nights to concerts, it's the experiences that make you smile and create lasting memories.

- Dining Out: Treating yourself to a delicious meal at your favorite restaurant or exploring new culinary adventures.

- Hobbies: Your passion projects and leisure activities that light up your day and make your heart sing.

2.3. Finding the Balance:

Allocating 30% for Wants is your way of having your cake and eating it too, but not the whole cake! It's about creating a balance between enjoying life and responsible spending. Here are some tips:

- Set Priorities: Identify what brings you the most joy and prioritize those experiences or items within your Wants category.

- Budget for Special Occasions: Save a bit extra in months with birthdays, holidays, or special events to fully enjoy those moments without financial stress.

- Look for Deals and Discounts: Maximize your fun budget by finding discounts, using loyalty programs, or exploring free activities in your community.

Remember, it's not about cutting out the fun; it's about making conscious choices. Your money superhero is here to help you enjoy life to the fullest while staying financially savvy. Ready to find that sweet spot? Let's do this!

3. Savings and Debt Repayment - 20% of Your Budget

Now, let's talk about the superhero cape of your budget—Savings and Debt Repayment. This category takes up a powerful 20%, and it's where your money gets serious about building a secure future:

3.1. Understanding the Significance:

Savings and Debt Repayment are like the backbone of your financial plan. It's not just about making ends meet; it's about building a foundation for a secure and stress-free future.

3.2. Why Save and Repay Debt?

Saving: Imagine having a financial safety net for unexpected twists and turns. That's what savings do—they provide a cushion for emergencies, opportunities, and peace of mind.

Debt Repayment: Crushing debt is like setting your finances free. It's about regaining control, saving on interest, and creating more room for the things you love.

Strategies for Success:

- Emergency Fund: Save at least three to six months' worth of living expenses. This fund is your superhero shield against unexpected challenges.

- Retirement: Contribute to retirement accounts like 401(k) or IRAs. It's your way of securing a comfortable and worry-free future.

- Debt Repayment: Prioritize high-interest debts first and consider strategies like the debt snowball or avalanche method.

3.3. Contributing to Long-Term Goals:

Allocating 20% to Savings and Debt Repayment is your ticket to long-term financial goals. It's like planting seeds for a lush garden—the more you nurture it, the more it grows. This category sets the stage for financial freedom, whether it's traveling the world, buying a home, or enjoying a comfortable retirement.

Your money superhero is here to ensure you're not just living for today but building a fantastic tomorrow.

4. Budgeting Tips for Success

Ready to level up your money game? Let's dive into some practical tips for mastering the 50/30/20 rule and making your budget a well-oiled machine:

Tip #1: Start with Real Numbers:

Know your exact income and current expenses. This superhero rule works best when you're working with real, not estimated, numbers. Check your bank statements, pay stubs, and bills to get the clearest picture.

Tip #2: Categorize with Care:

Be clear about what falls into the Needs, Wants, and Savings/Debt Repayment categories. Categories help you understand where your money is going and where you can make adjustments if needed.

Tip #3: Track Your Spending:

Keep a spending diary or use budgeting apps to track every penny. This superhero power lets you spot trends, identify areas for improvement, and stay accountable to your financial goals.

Tip #4: Adjust as You Go:

Life changes, and so should your budget. If you get a raise, have a new expense, or experience a shift in priorities, adjust your 50/30/20 allocations accordingly. Flexibility is key to long-term success.

Tip #5: Build a Buffer:

Allocate a bit extra for unexpected expenses or fun splurges. This buffer zone ensures you're prepared for surprises without jeopardizing your financial goals.

Tip #6: Prioritize High-Interest Debt:

If you have high-interest debt, consider tackling it first. It's like removing a weight from your shoulders and freeing up more money for your Wants and Savings categories.

Tip #7: Celebrate Small Wins:

Every milestone deserves a high-five! Whether it's paying off a credit card or reaching a savings goal, celebrate your achievements. It keeps you motivated and excited about your financial journey.

Remember, budgeting is a tool to empower you, not restrict you. The 50/30/20 rule is your guide, but the power is in your hands.

5. Empower Your Budget with the 50/30/20 Rule Calculator

Ready to turn your budgeting journey into a seamless experience? Say hello to our exclusive feature—the 50/30/20 Rule Calculator! This interactive tool is designed to simplify the application of the 50/30/20 rule to your unique financial situation.

5.1. How to Use the Calculator:

Enter Your Monthly Income: Start by inputting your monthly income into the designated field.

Click "Calculate": Hit the "Calculate" button, and watch the magic unfold.

Needs (50%)

Wants (30%)

Savings (20%)

Congratulations, savvy budgeteer! You've just unlocked the secret to stress-free money management—the 50/30/20 rule. Let's wrap up our financial adventure with a quick recap and a sprinkle of encouragement to kickstart your budgeting journey:

Remember, managing money can be simple and achievable. Embrace the power of budgeting, and watch how it transforms your financial well-being. Optimism awaits on this journey—less stress, more financial freedom!